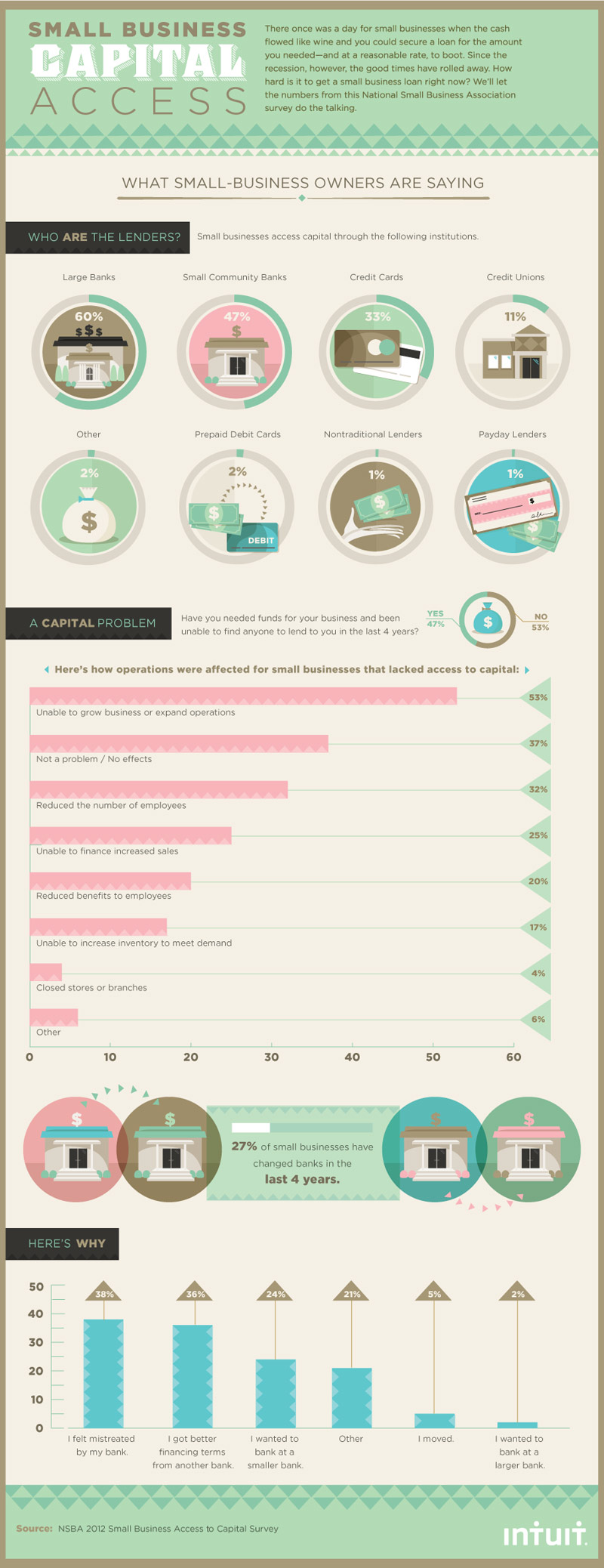

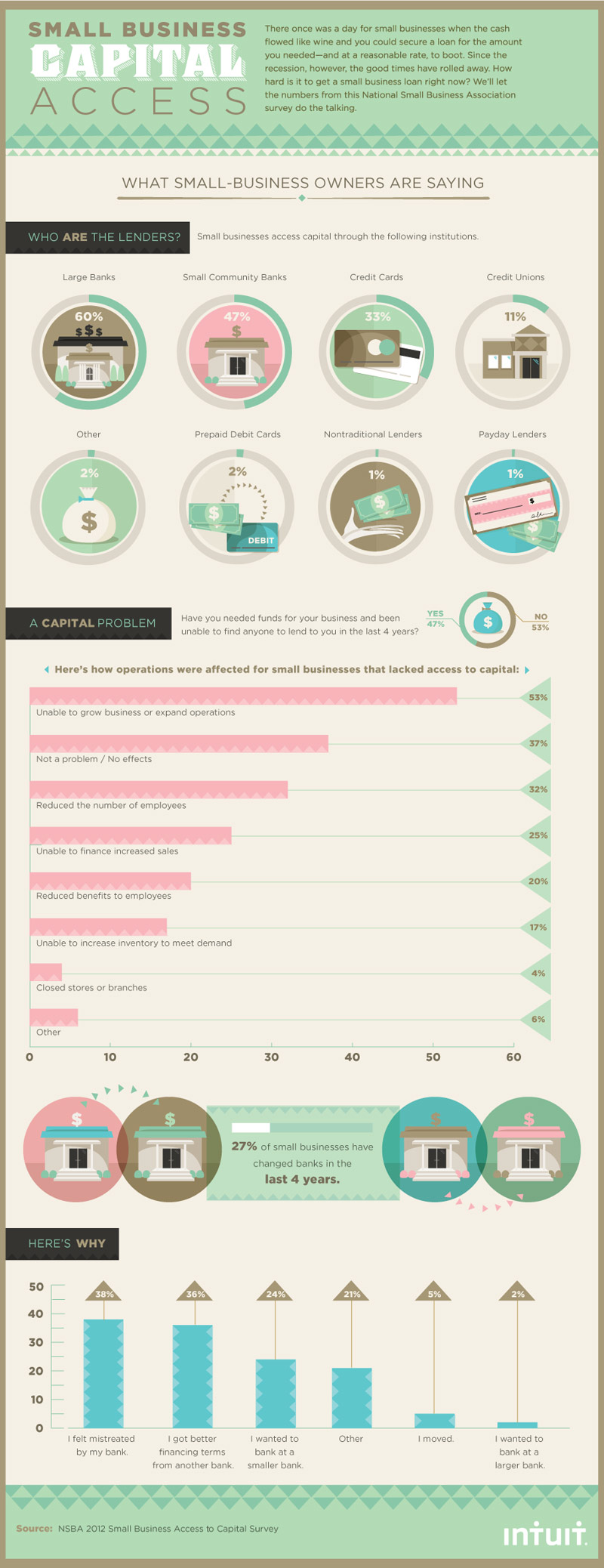

Access to capital is one of the most important factors in successfully starting or growing your business, but finding enough money may be a problem for many small-business owners. According to a 2012 survey from the National Small Business Association (NSBA), 47 percent of small businesses were unable to find a lender in the previous four years.

Those founders that did secure funds did so largely through banks, with 60 percent getting loans from large banks, and 47 percent from smaller community banks.

While the majority of small-business owners surveyed didn't have to close their businesses due to lack of money, more than half (53 percent) reported that it hindered growth or expansion.

For more details on how small businesses are finding loans, take a look at the infographic below from accounting software firm Intuit.

This post originally see http://www.entrepreneur.com/article/226535 here

This post originally see http://www.entrepreneur.com/article/226535 here

Home

Home